- Antstolių informacinė sistema

- Aplinkos pasirinkimas

- CR.lt web service

- CR rating

- Essential mark

- IMK paslauga mėnesiui

- IMK paslauga (metinė narystė)

- CrefoCert STABILUS

- Išsami Hipotekos registro informacija

- Informacijos monitoringas

- Nekilnojamas turtas

- Trumpasis nekilnojamo turto išrašas

- Parduodamos skolos

- Paruošta informacija

- Prepared credit report

- Skolų Sodrai rodiklis

- SODRA information: salaries

- Transporto priemonių paieška

- Transporto priemonių sąrašas

- Turto arešto aktų registro ir Hipotekos registro trumpoji žinutė

- Turto areštų išsami informacija

- Užskaitos

- Vėlavimai

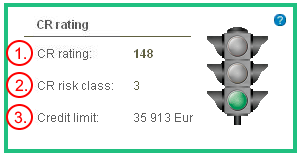

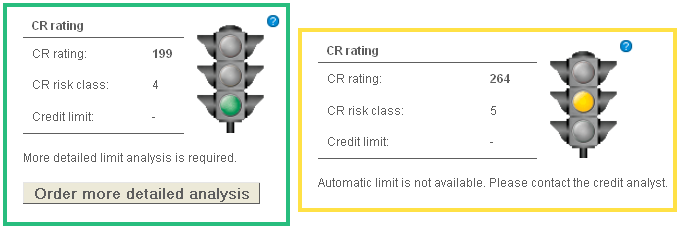

CR rating informational block indicates the generalized company‘s risk evaluation, taking into account various insolvency factors, sectors‘ tendencies, financial data.

One can use the simplified risk scale-traffic light or:

- CR rating - riskiness scale from 10 (impeccable creditworthiness) to 600 (bankruptcy).

- CR risk class - more generalized riskiness classification from 1 to 10 for easier crediting decision making.

- CR limit - maximal credit limit permissible for all creditors applying 30 days deferral term.

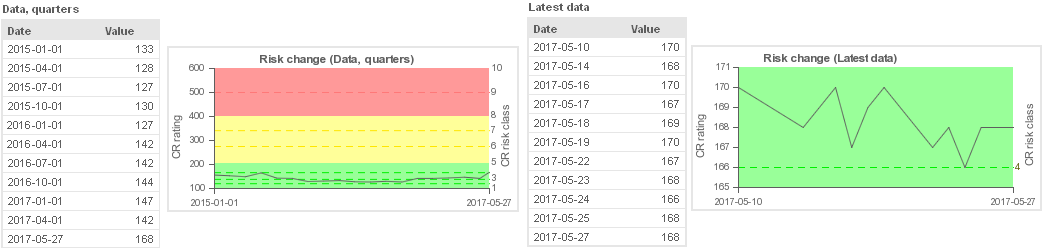

Below CR rating changes during short and long time periods is presented in tables and graphs.:

Wide variety of different indicators is used for calculation of values from CR rating information block:

- Data from official Registers such as legal entities, asset arrests acts registers, bankruptcy departments‘ and courts‘ informational systems.

- Financial data, which is gathered from official registers or (periodically) provided by companies.

- Other risk factors – ongoing debt recovery procedures, entered payment delays, information from "blacklists".

- General statistical indicators of sector or region — insolvency distribution, trends in asset arrests acts‘ and other negative information, data provided by statistics department and other.

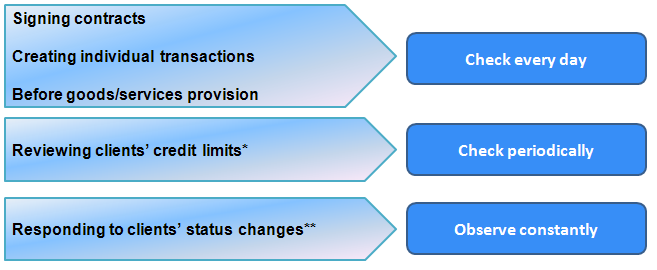

When to use? ➤

It is recommended to use CR rating informational block for search of new (solvent) clients, credit terms decisions, execution of pricing besed on risk evaluating.

* View the service "Clients’ risk evaluation"

** View the service "Informational monitoring"

How to evaluate? ➤

When the judgement if it is advisable to start collaboration is needed, it is recommended to use CR rating evaluation (for detailed analysis), values of CR rating class (if simpler evaluation is enough) or just scale of three colours traffic light (for simplified decision making).

| CR rating class | CR rating value | |

|

1. Impeccable | 100 – 119 |

| 2. High creditworthiness | 120 – 137 | |

| 3. Good creditworthiness | 138 – 165 | |

| 4. Higher than average creditworthiness | 166 – 207 | |

|

5. Average creditworthiness | 208 – 274 |

| 6. Lower than average creditworthiness | 275 – 340 | |

| 7. Low creditworthiness | 341 – 403 | |

|

8. Very low creditworthiness | 404 – 499 |

| 9. Insolvency | 500 – 599 | |

| 10. Bankruptcy and liquidation | 600 |

If (using CR rating information) it is decided to start/prolong collaboration and the client is asking for a deferral of payment, it is advisable to use CR limit information. Automatically calculated maximal credit limit with 30 days deferral term is presented in CR rating table. It is worth mentioning that, due to automation of this limit, some of factors are not taken into account. These include specific relations with client, importance according to business sectors, clients’ number and so on.

Therefore, these changes can be imposed in particular cases while evaluating maximal credit limits:

- Reduction or increase of CR limit accordingly reducing or increasing the deferral term;

- CR limit correction according to sums of whole credits/deferrals, overall number of clients, companies “importance” in activity of the analyzed company;

- Other changes, taking into account some reasons known to you (specific relations, other).

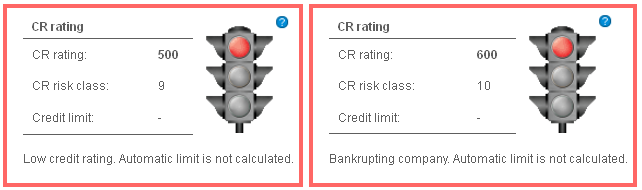

Specific cases ➤

There are sevaral different cases when CR limit is not indicated. At first, CR limit is never calculated for companies to whom CR rating is not calculated (companies with low turnover, new or unregistered companies).

Other cases:

- The company‘s CR rating class is higher than 7 or the company is unregistered/bankrupted (class 10).

-

When additional automatic examination is needed and missing data should be imported. In this

case the one can order limit calculation service, which is provided with a fuller information

set. If the company has not provided additional data for credit limit evaluation, You will

get recomendation to contact credit analys and/or order credit report.

Why its is valuable? ➤

+ CR rating saves time and money – less pocessing and analysis of big amount of data, less funds for additional data purchase.

+ Accurate: generalizes big amounts of data and presents clear and breaf conclusion regarding the potential of business relations.

+ "Fresh" – updated every day. Reflects the newest status changes of the company at once.

+ Comfortable – no need to wait, to go anywhere. Just open the site www.cr.lt:

- CR rating is presented together with the main company‘s data in the first page.